— China Edition —

LE’s New Business Opportunities

Your quarterly pulse on hotel development trends and LE news

China’s Hotel Construction Pipeline Ends 2020 with 3,375 projects/639,811 rooms

According to the latest China Construction Pipeline Trend Report from Lodging Econometrics (LE), China’s total hotel construction pipeline dipped slightly at the end of Q4 ’20 to stand at 3,375 projects/639,811 rooms, down 4% by projects and 1% by rooms year-over-year (YOY). This is the second quarter off the peak reached in Q2 ’20, where construction pipeline totals stood at 3,574 projects/647,704 rooms. However, due to China’s robust manufacturing and export industry their GDP has remained strong throughout the pandemic, as has their construction industry.

China currently has 2,293 projects/413,874 rooms under construction, an increase of 3% by projects and 2% by rooms over last quarter’s totals. Projects scheduled to start construction in the next 12 months stand at 641 projects/116,884. Projects in the early planning stage stand at 441 projects/109,053 rooms, down an incremental 1% YOY.

The country opened 910 hotels/114,502 rooms in 2020. In Q4 ’20, China saw 176 new hotels accounting for 25,442 rooms open. LE is forecasting another 840 projects/131,197 rooms to open in 2021 and 994 projects/169,716 rooms to open in 2022.

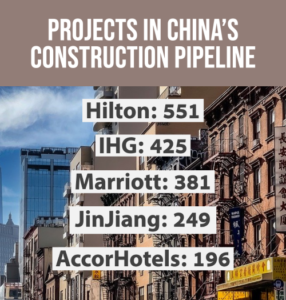

Hilton, IHG, Marriott, JinJiang, and Accor top hotel construction in China

Franchise companies topping China’s construction pipeline are Hilton Worldwide with project and room record totals of 551 projects/109,254 rooms. InterContinental Hotels Group (IHG), is also recording all-time high project counts with 425 projects/90,630 rooms, and Marriott International, is setting record high project and room counts as well, with 381 projects/104,485 rooms. Next is JinJiang Holdings with 249 projects/24,865 rooms and AccorHotels with 196 projects/34,263 rooms.

Franchise companies topping China’s construction pipeline are Hilton Worldwide with project and room record totals of 551 projects/109,254 rooms. InterContinental Hotels Group (IHG), is also recording all-time high project counts with 425 projects/90,630 rooms, and Marriott International, is setting record high project and room counts as well, with 381 projects/104,485 rooms. Next is JinJiang Holdings with 249 projects/24,865 rooms and AccorHotels with 196 projects/34,263 rooms.

Hilton Worldwide’s top brands are Hampton by Hilton, at an all-time high, with 327 projects/49,909 rooms. Hilton’s second-largest brand, also with an all-time high project count, is Hilton Garden Inn with 70 projects/15,228 rooms. IHG’s leading brand in China is Holiday Inn Express with 198 projects/33,255 rooms and then Holiday Inn, with a record number of projects and rooms, at 71 projects/17,520 rooms. Marriott International’s top brands are Marriott Hotel & Resorts with 62 projects/18,831 rooms and Sheraton Hotel, at an all-time high, with 61 projects/18,633 rooms. Leading brands for JinJiang Holdings are 7 Days Inn with 106 projects/8,341 rooms followed by Vienna Hotel with 61 projects/5,962 rooms. AccorHotels’ leading brands are the Ibis brands with 75 projects/7,942 rooms and Mercure Hotel with 54 projects/9,004 rooms.

Chengdu leads China’s pipeline

Chengdu leads China’s hotel construction pipeline with 133 projects/27,304 rooms. Next is Shanghai at 130 projects/25,215 rooms, followed by Guangzhou with 125 projects/25,139 rooms, then Wuhan with 103 projects/13,890 rooms and Xi’an with 89 projects/16,006 rooms.

Chengdu leads China’s hotel construction pipeline with 133 projects/27,304 rooms. Next is Shanghai at 130 projects/25,215 rooms, followed by Guangzhou with 125 projects/25,139 rooms, then Wuhan with 103 projects/13,890 rooms and Xi’an with 89 projects/16,006 rooms.